We assure you for getting the 90% and above of your requirement in financial management. Why we are being so sure and confident, so as we have delivered so many similar assignment that you are submitting us now

All your requirement in our features

Real time Help

We are here to help you with your really urgent assignment. We have our inhouse writers who are ready to help you on the time given. we are all time available to get you the best deal.

Customised work

We assure you to provide customised work, that will be as per the guidelines as well as per the requirement that needed for your paper

99% Plagfree Work

Universities are very strict about the Plagrisim work , so do we are. We understand how it can affect your career, we make sure you receive 99% Plagrisim free work

Instant Response

We understand the busy schedule, that is why we are working day and night to ensure, we do not miss any of your call in case of need. You can connect us anytime on LIVECHAT

Easy to Connect

We have various platform to get in touch with us. you can text us via LiveChat, Whats app, Call, Messages, If you don't like filling the forms, you directly can email us on info@headmastersfoundation.com

Easy to us the interface

The technical team has design this website customer friendly so that you do not need to hustle while submitting your assignment to us.

Lets read more about Financial management

We will be adding a brief knowledge of a section of financial management and financial decision.

Financing decision or Financial Management:

When we heard of “Financing decision or Financial Management‘ in very simple words we think of money management and decisions to be taken on money forecasting. well, that is true enough with small parameters and small budgetary matters.

Finance management shows us the time value of money for one period to another period. It is not as easy as it seems, for example, if we go back 10 years ago, we will find we were able to manage and save $10 at the same cost of expense, But the question is can we do it now? No, because time has changed, the value of price has arisen. Now we have to understand the changes in market value, current value as well as the changes that are about to happen in future value. This way we would be able to make an understanding of how the financial market work.

What are the sources of Finance for a Company?

- Shareholders Fund

| Equity Share Capital |

| Retained Earnings |

| Preference Share Capital |

2. External Borrowing

| Long Term Borrowings |

| Debt/Debentures |

| Long term Loan/ Bonds Etc |

How Financing Decisions Affect Cost of Capital?

Cost of capital refers to the cost incurred at the time of acquiring capital. When a company acquires the capital it has to pay the landers some amount apart from the principle given. COC is also known as “CUT OFF‘ Rate “MINIMUM” Rate “HURDLE” Rate OF RETURN.

It is very important to understand that excess cost of capital may lead the company in the wrong direction, it is important to make it optimum as much as a company can. Correct arrival of COC helps the company in cost management, financial management also in financial decision making.

How to determine the correct cost of capital? How does it Impact Finance Management?

Cost of capital can be in nature of Explicit cost or implicit cost in very simple words. any outflow related to acquiring the capital for the company will be explicit cost, for example, cash outflow for the interest of debenture, long-term loans, etc. In another hand an opportunity cost that could be saved, called implicit cost for example loss of forgoing a better investment in the organization.

There are two source by within we can determine the Cost of Capital.

- Source Finance:

- Reverse payment of using finance

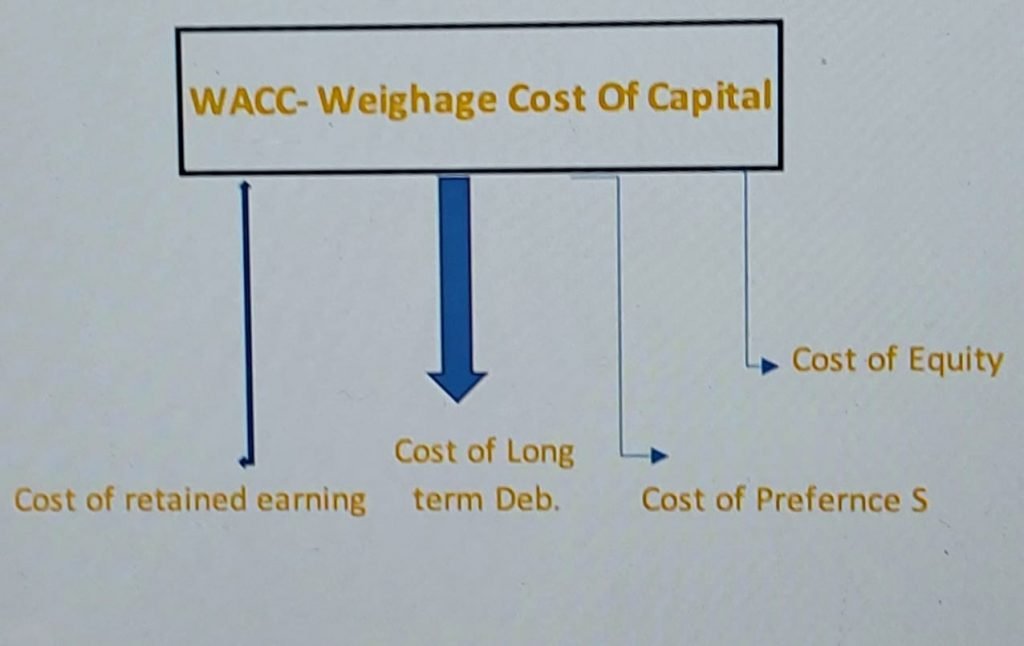

What is the Weighted Average Cost Of Capital?

The weighted average cost of capital is the overall cost of capital that has been acquired from different sources. It gives us the estimated cost of all the cost of capital. It helps us identify the company’s current position. Weighted Average Cost Of Capital varies from different cost structures of different companies. It helps us to propose a new optimum level of capital acquisition in which it will be healthier for the business in the long run.

Calculation of Weighted Average Cost Of Capital. Calculate the total capital from all the sources acquired.

- Step 1: Each source of capital to total capital

- Step 2: Calculate the proportion of each cost of capital, = Equity share capital / Total share capital

- Step 3. Multiply all the pro-potion of the capital with its corresponding cost of capital.

- Step 4. Last but not least. Add all the cost of capital calculated after multiplying promotions. This will be the (WACC)Weighted Average Cost Of Capital

Taking finance decisions is a big task, as it affects the various sources of cost structure, finance structure, finance management, etc. Financial management has a various parts that makes a great empire to run over, it takes time money and efforts to carry forward in long run.

Check out our Academic writing article. You will surely find it useful.

The above article might be able to help you in your topic to understand. If you have any queries or doubt please do let us know in the comment box.